More and more practices are creating their own in-office payment plans where patients pay a monthly payment to the practice to receive treatment. This can be an excellent strategy when structured correctly for your practice. Most offices manually collect payments and don’t have a great agreement in regards to in-office membership programs. In this article, I am going to share some benefits as well as tips on offering this kind of payment plan for your patients.

Benefits of Care Credit

Fist and foremost, I think Care Credit is a wonderful option and I think it can really help your practice collect a lump sum of payments as well as help your patients receive the care they need. I also think Care credit should be used as a fist solution to patient financing. They are a great partner for your practice and can help your practice increase case acceptance. But what if your patient doesn’t want to use Care credit? or what if it is for treatment that would only take 3 – 6 months to pay off? I think an in-office payment plan can be a great solution if structured properly. Let’s talk about some of the benefits.

Automated monthly cash flow

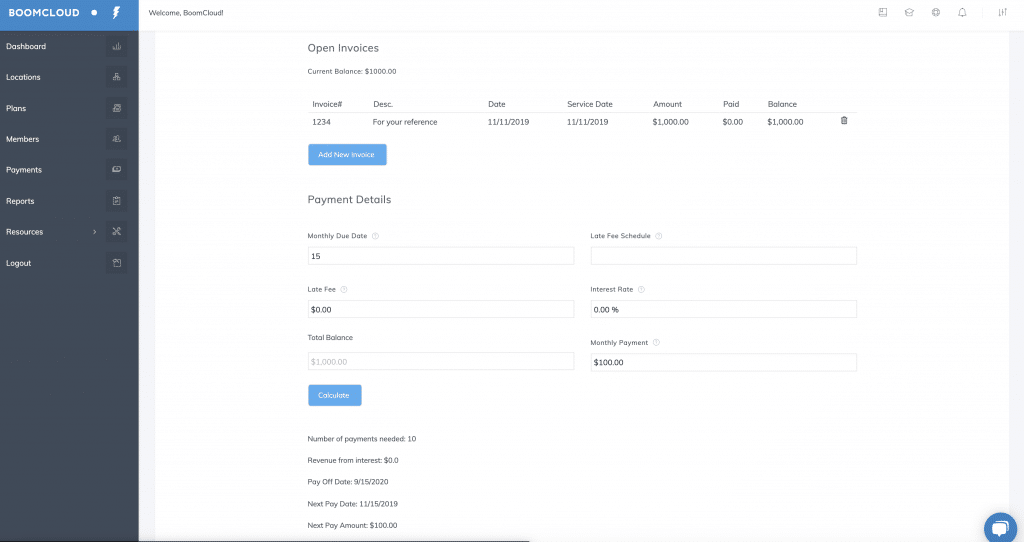

If you structure an in-office payment plan make sure you automate the payments from your patient. If you use BoomCloud you can easily set up a payment plan in addition to your membership plan and withdrawal funds directly from the patient bank account, which is more stable and less expensive in regards to merchant fees. Automated payments help with your monthly cash flow and using ACH will ensure that your practice collects payment from your patient every month on a specific date. Here is a snapshot of how to set up in-office payment plans in BoomCloud:

You can easily add a “balance due” create a monthly due date, add a late fee schedule and even add your own interest rate. I recommend doing in-office payment plans when a patient doesn’t want or can’t do Care Credit.

Interest cash flow

You can create your own interest rate which adds another stream of passive/recurring revenue for your practice. When you add this make sure the patient signs an agreement that spells out all the details of their payment plan to your office.

Increases patient acceptance

Another benefit of creating your own payment plan for treatment is that patients are more likely to say yes to treatment when it is convenient for them. Allowing patients to pay a small monthly payment for 3 – 6 months might be the catalyst for them to choose and accept your treatment.

Tips when setting up an in-office payment plan

Make sure when you are setting up an in-office payment plan that you have your patient sign an agreement with your practice. I recommend checking out RocketLawyer.com’s agreement for simple payment plans. You can either subscribe each month to RocketLawyer.com to get access to all sorts of agreements that will help you manage your practice or you can pay per agreement created. They have a very useful and unique agreement builder that allows you to set up a custom agreement in minutes. Also, make sure you are collecting the payment automatically on a specific day, your team does not need more administrative tasks to do each day on top of insurance admin tasks and helping patients.

If you are interested in learning more about how BoomCloud can help your practice manage both membership programs and payment plans for treatment, I suggest you schedule a quick live demo with our team.