I have been re-reading a lot of my favorite business books lately and decided to share my thoughts from what I have learned from these books over the years as well as what I have currently learned from bootstrapping (growing business without investors and focusing on customers) BoomCloud. Passive income is one of the most important revenue components to business and wealth-building. As a practice owner, you should be looking for these opportunities within your practice and opportunities to invest outside of your practice.

7 books you need to read:

- Rich Dad, Poor Dad

- The Automatic Customer

- The Membership Economy

- Tax-Free Wealth

- Cash Flow Quadrant

- The Personal MBA

- Profit First

What is passive income?

According to Wikipedia:

Passive income is income that requires little to no effort to earn and maintain. It is called progressive passive income when the earner expends little effort to grow the income. Examples of passive income include rental income and any business activities in which the earner does not materially participate.

Buy or Create Assets, Avoid liabilities

Assets put cash flow into your pocket, Liabilities take cash flow away from you. Robert Kiyosaki, the author of Rich Dad, Poor Dad created this quick video on assets and liabilities.

Recession-Proofing with Passive Income

I managed a dental lab during the great recession and realized that passive income is a tool to recession-proof and build wealth during good or bad times. A true business has multiple streams of revenue and passive income/recurring revenue is part of the revenue mix. Here is a quote from John Warrillow the author of The Automatic Customer:

“One of the best parts about creating Automatic Customers through subscriptions is that you insulate yourself from the worst of a potential recession.”

When you have recurring revenue coming in each month from hundreds or thousands of membership patients you will create a solid cash flow foundation for your practice and can withstand economic downturns, shutdowns and recessions.

Passive Income from Membership Plans

A membership program is an example of a passive income stream you can create within your office. it is passive because it generates predictable recurring revenue, you also generate revenue that is automatically collected whether you do dentistry or not.

See the example below:

Passive Income Metrics

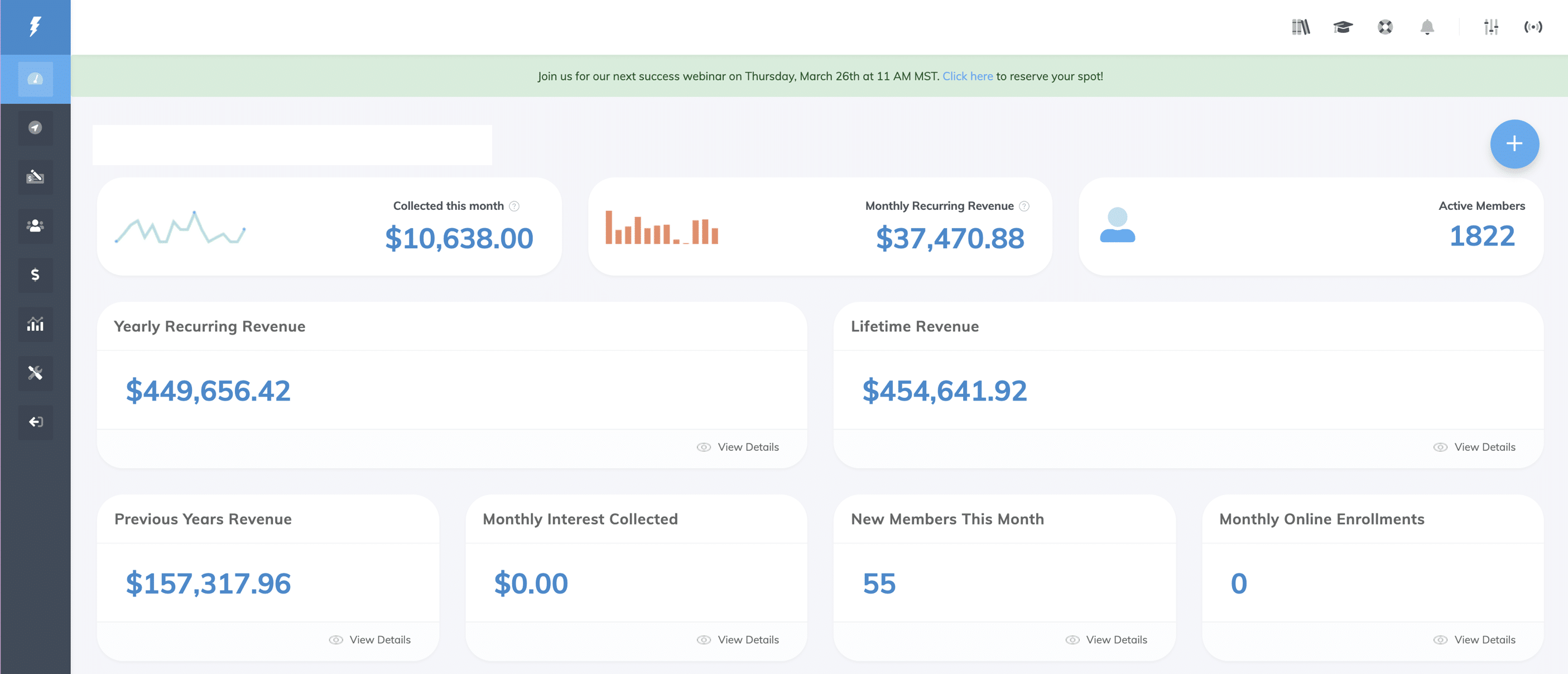

When you implement passive income from your own dental membership program you install a new business model into your practice that requires a new set of metrics to keep track of.

MRR & ARR – Monthly recurring revenue & Annual recurring revenue are two metrics that measure passive income. Most practices that manually run a membership program have no clue how much MRR is being generated from their plan. What you measure you grow and your time as a practice owner should be focused on income generation and passive income,

Automated Collections – You also need to keep track of the actual revenue collected each month/year.

Active Members – More members = more passive income. Track it every day, week and month

Expansion Revenue – Revenue generated from members/subscribers in addition to membership fees.

Churn – Cancellations each month, quarter, or year. Churn is critical, make sure you are not losing more subscribers than new sign-ups.

*Don’t be the kind of office that doesn’t track these key metrics to help you grow your passive income.

Benefits of Passive Income

Since the COVID-19 shut down passive income has become even more important to implement in your practice. The key is to create multiple streams of passive income. Here are just a few benefits of creating passive income for yourself.

- Passive income gives you the freedom of time

- It reduces your stress, anxiety, and fear of the future

- It allows you to pursue doing the things you love rather than what pays the bills

- It gives you the ability to live and work from anywhere

- It provides a platform for financial stability and growth

Systems & Processes Help You Scale

Business systems should be the heart of growing passive income for your membership program and for your practice. Here is a list of systems to help you scale and earn more passive income from your practice:

- Hiring System

- Numbers/data System

- Planning & Goal Systems

- Employee Management/Review systems

- Financial Systems

- New Patient Onboarding Systems

- Marketing/sales Systems

Conclusion

BoomCloud helps you scale passive income & Financial Sytems. I recommend you schedule a demo today and start building your own passive income streams. Also, Check out this webinar I did with Dr. Brady Frank about recession-proofing strategies and passive income: