Alright, dental rockstars, let’s get one thing straight: Talking about money in your dental office doesn’t have to be as awkward as a root canal without anesthesia. Seriously. If you’re still relying on old-school financial agreements that sound like they were written by lawyers who moonlight as party poopers, it’s time to upgrade your game.

In this article, we’re diving into the world of creating a financial agreement for a dental office. But hold up—don’t worry, this isn’t legal advice. For that, go call your friendly neighborhood attorney. This is more like friendly, fun, and fiercely practical advice to make those money talks smoother than a freshly polished crown.

We’re also going to explore the king of all financial agreements: Patient Membership Plans. We’ll talk about how they make your patients happy, your staff stress-free, and your revenue rock-solid. Plus, I’m throwing in some juicy case studies featuring Wood River Dental and 7 to 7 Dental to prove just how game-changing this can be.

So, let’s dig in!

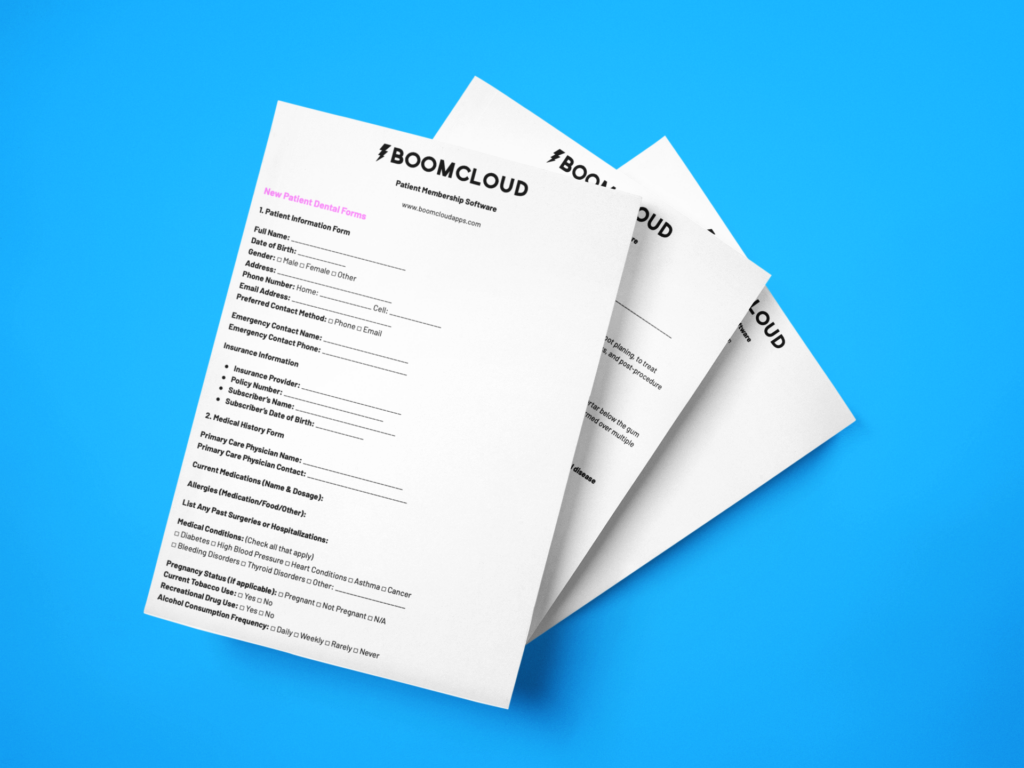

Download this Financial Agreement for a Dental Office + many other templates & resources!

How to Create a Financial Agreement for a Dental Office

Step one: Make your financial agreement clear, concise, and as friendly as possible. Patients shouldn’t need a law degree to understand how they’re paying for treatment.

1. Use Simple Language

No one wants to read legal jargon, especially when they’re already nervous about that crown prep. Use simple, straightforward language. Instead of “hereby agrees to remit payment,” try “agrees to pay.” See? Easy.

2. Include All Payment Options

Outline every way a patient can pay: cash, credit card, financing plans, or—my personal favorite—your patient membership plan. Make sure to include any policies about late payments or missed appointments.

3. Be Transparent About Costs

Clearly list what’s included in the treatment plan and how much it will cost. If there are potential extra charges, make sure to disclose them.

4. Get Their Signature

Make sure the patient signs the agreement, either digitally or on paper. This makes everything official and avoids those “I didn’t know it would cost that much!” moments.

Disclaimer: This isn’t legal advice. Consult your lawyer to make sure your financial agreement is ironclad.

The Best Type of Financial Agreement: Patient Membership Plans

Now, here’s where things get really fun. Sure, you could stick to traditional financial agreements. But why settle for old-school when you could offer something that benefits everyone? Enter: Patient Membership Plans.

What Are Patient Membership Plans?

Think of them as the Netflix of dental care. Patients pay a monthly or annual fee to get access to preventive care (like cleanings, exams, and X-rays) plus discounts on additional treatments. No insurance needed, no headaches, no “I’ll have to call my provider” nonsense. Just simple, affordable, and easy dental care.

How Membership Plans Help Patients

- Predictable Costs: No one likes surprise bills. Membership plans make it easy for patients to budget for dental care.

- Discounted Treatments: Members usually get 10-20% off other services, which makes saying “yes” to treatment a no-brainer.

- VIP Experience: Patients feel special, and let’s face it, who doesn’t like feeling like a VIP?

How Membership Plans Help Your Office

- Recurring Revenue: Membership fees create a predictable revenue stream. It’s like having money on autopilot.

- Fewer Insurance Headaches: Say goodbye to dealing with stingy insurance companies and hello to getting paid directly by patients.

- Higher Case Acceptance: Patients on membership plans are more likely to say “yes” to treatment because they’re already financially invested in their oral health.

How Membership Plans Help Your Team

- Less Stress: Your front desk won’t have to spend hours on the phone fighting with insurance reps. Hallelujah!

- Simplified Billing: Collecting payments becomes a breeze. No more chasing down unpaid balances.

- Happier Patients: When patients are happy, your team is happy. Simple math.

Example Membership Plan

Here’s a simple breakdown to get your wheels turning:

- Individual Plan: $30/month or $360/year. Includes two cleanings, exams, and X-rays per year, plus 15% off other treatments.

- Family Plan: Discounted rate for additional family members. Because, let’s be real, kids’ teeth are just as important.

Why Membership Patients Spend More

Let’s break down the numbers. Membership patients have a 40%+ case acceptance rate, compared to 35% for PPO patients and a measly 24% for cash patients. But wait, there’s more! Membership patients also spend 2X to 5X more on treatments. Why? Because they’re already financially committed, and they see the value in maintaining their dental health.

BoomCloud™: The Ultimate Membership Plan Software

Managing a membership plan manually? No, thank you. That’s a nightmare you don’t want. BoomCloud™ automates billing, sends renewal reminders, and gives you analytics to track your MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue). It’s like having a financial wizard working behind the scenes.

Learn More About BoomCloud™: BoomCloud™ – Membership Plan Software

Case Study: Wood River Dental

Wood River Dental wanted to boost their case acceptance and simplify their revenue. They launched a membership plan with BoomCloud™, and here’s what happened:

- Members Signed Up: 800 patients at $45/month

- Monthly Recurring Revenue (MRR): $36,000

- Annual Recurring Revenue (ARR): $432,000

- Patient Spend: Membership patients spent 3.5X more on additional treatments.

The Result? More predictable revenue, happier patients, and a team that could finally breathe easy without dealing with insurance hassles.

Case Study: 7 to 7 Dental

7 to 7 Dental took things to the next level. They wanted to reduce their reliance on PPOs and increase patient loyalty. Here’s what their BoomCloud™ membership plan achieved:

- Members Signed Up: 2,300 patients at $40/month

- Monthly Recurring Revenue (MRR): $92,000

- Annual Recurring Revenue (ARR): $1,104,000

- Patient Spend: Membership patients spent 4X more compared to PPO patients.

The Takeaway? Membership plans don’t just boost revenue; they create a community of loyal patients who value your care.

Final Thoughts: Financial Agreement for a Dental Office

If you’re tired of the old-school financial agreement drama, it’s time to switch to something that works. Patient membership plans make everyone’s life easier—yours, your team’s, and your patients’. And with BoomCloud™, you can manage your plan effortlessly and watch your revenue soar.

Ready to transform your financial agreements and your practice? Sign up for BoomCloud™ and get started today!

Sign Up for BoomCloud™ Here: BoomCloud™ – Membership Plan Software

Now go out there, simplify those financial agreements, and make your practice a revenue-generating powerhouse!