Let’s talk about something most dentists dread: the money conversation & Dental Financial Agreements. You know, that awkward moment when a patient’s face drops after hearing their treatment cost. It’s enough to make you wish you were still in dental school instead of dealing with the grim realities of practice ownership.

But what if I told you there’s a way to make financial discussions smooth, simple, and dare I say, seamless? The answer lies in dental financial agreements and—wait for it—patient membership plans.

When you pair clear financial agreements with a rock-solid membership program, not only do you boost case acceptance, but you also create loyal patients who spend more, stay longer, and refer their friends. And with tools like BoomCloud™, it’s easier than ever to implement these strategies.

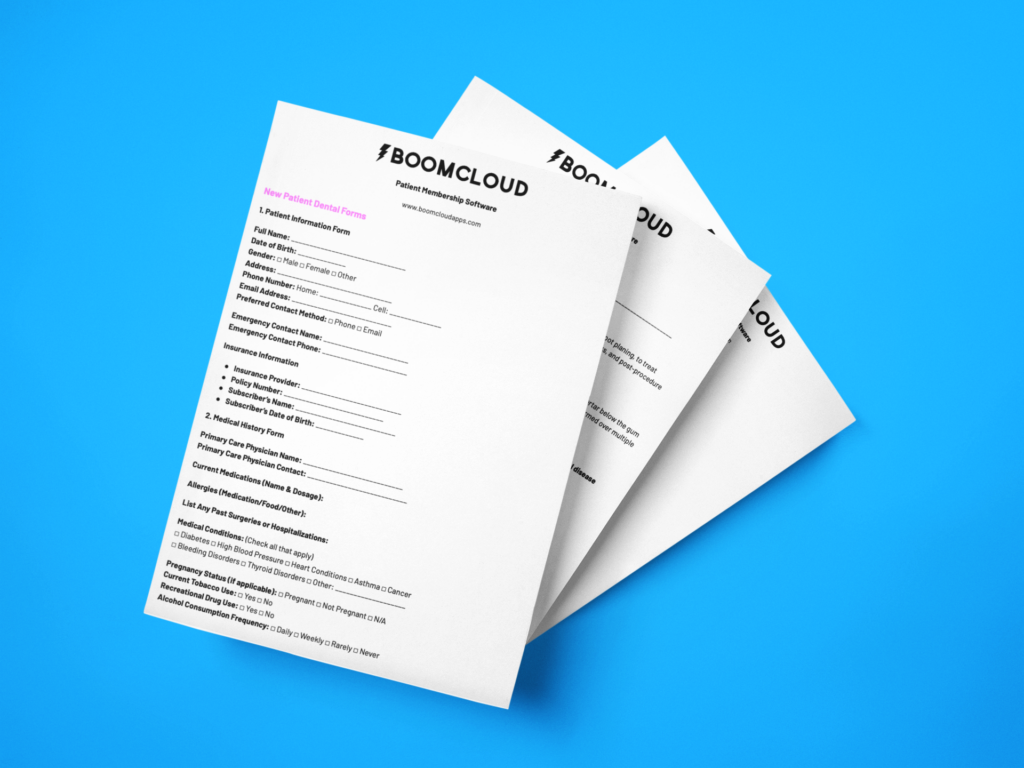

Download our free dental financial agreement template plus other forms and templates for your dental office!

What Is a Dental Financial Agreement?

A dental financial agreement is a written document that outlines the cost of treatment, payment terms, and any financing options available. Think of it as the playbook for your patients’ payment journey—it removes uncertainty and builds trust.

Key Elements of a Financial Agreement

- Treatment Costs: Itemized list of services and their associated fees.

- Payment Options: Include upfront payments, financing plans, or membership discounts.

- Terms and Conditions: Ensure patients understand deadlines, penalties for late payments, and cancellation policies.

- Signatures: Seal the deal with patient and provider signatures to ensure accountability.

Why Financial Agreements Increase Case Acceptance

1. They Reduce Sticker Shock

Nobody likes surprises—especially when it comes to money. A clear financial agreement helps patients process costs without feeling overwhelmed.

2. They Build Trust

Transparency is key. When patients know exactly what they’re paying for, they’re more likely to commit.

3. They Offer Flexibility

Including options like payment plans or membership discounts makes treatment accessible to more patients, increasing your acceptance rates.

Case Acceptance Rates: PPO vs. Cash vs. Membership Patients

Here’s the breakdown of case acceptance rates for different patient types:

- PPO Patients: 38% case acceptance.

The downside: Reduced fees, insurance red tape, and delayed cash flow. - Cash Patients: 24% case acceptance.

The downside: Patients pay upfront, often limiting their willingness to proceed. - Membership Patients: 40%+ case acceptance.

The upside: Patients pay a subscription fee, are loyal, and trust you with their care. Membership patients also spend 2X to 5X more than PPO and cash patients.

Pro Tip: Membership plans create a sense of financial commitment, making patients more likely to say “yes” to treatment recommendations.

Why Membership Plans Are a Game-Changer

A membership plan is like a Netflix subscription for your dental practice. Patients pay a flat monthly or annual fee in exchange for routine care and discounts on additional treatments. It’s simple, affordable, and mutually beneficial.

Benefits of Membership Plans for Your Practice

- Predictable Revenue: Monthly recurring income stabilizes your cash flow.

- Higher Case Acceptance: Membership patients are pre-invested and more likely to approve treatment.

- Loyalty for Life: Patients stick around longer and refer friends.

How BoomCloud™ Simplifies Membership Management

Managing a membership plan might sound complicated, but that’s where BoomCloud™ comes in to save the day.

What BoomCloud™ Does Best

- Automates Billing: Patients are billed monthly or annually without you lifting a finger.

- Tracks Revenue: Get real-time insights into your MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue).

- Customizes Plans: Tailor your membership program to fit your patients’ needs and your business goals.

Learn More About BoomCloud™ Here: BoomCloud™ – Membership Plan Software

Case Study: Wood River Dental’s Membership Success

The Challenge

Wood River Dental wanted to reduce their dependence on PPOs and improve case acceptance rates for high-ticket treatments.

The Solution

They launched a membership program using BoomCloud™, offering:

- Free cleanings and exams.

- 20% discounts on crowns, fillings, and whitening.

- Free emergency exams for peace of mind.

The Results

- Members Signed Up: 1,500 patients at $45/month.

- Monthly Recurring Revenue (MRR): $67,500.

- Annual Recurring Revenue (ARR): $810,000.

- Case Acceptance Rates: Membership patients approved treatment 40% of the time, compared to just 38% for PPO patients and 24% for cash patients.

“BoomCloud™ made managing our membership program effortless, and our patients love the savings,” says Dr. Loyal Patients Forever.

How to Use Financial Agreements With Membership Plans

1. Offer Membership Discounts in the Agreement

Include membership perks directly in your financial agreement to make it a no-brainer for patients to sign up. Example:

“As a member, you’ll save 20% on this treatment plan. Join today for just $45/month!”

2. Pair Financing Options With Membership Plans

Combine third-party financing (like CareCredit) with membership discounts to make treatment even more accessible.

3. Train Your Team to Promote Membership Plans

Your team should confidently explain the benefits of membership plans and how they reduce costs for patients.

Final Thoughts: Boost Case Acceptance With Financial Agreements and Membership Plans

Financial agreements are the unsung heroes of case acceptance, and when paired with a direct dental care membership program, they’re unstoppable. By offering transparency, flexibility, and affordability, you’ll build trust, increase patient loyalty, and grow your revenue.

With BoomCloud™, managing your membership plan is easier than ever. You’ll have more time to focus on what you do best: providing exceptional care.

Ready to transform your practice? Sign up for BoomCloud™ today and start building your membership empire.

Sign Up for BoomCloud™ Here: BoomCloud™ – Membership Plan Software

Now go out there, write those financial agreements, and watch your case acceptance rates skyrocket!

Download our free dental financial agreement template plus other forms and templates for your dental office!